Property Tax in Spain

First thing to consider when buying a property in Spain is taxes and legal fees, when buying a property in Spain be prepared for some extra costs as they can accumulate up to about 15% of the properties value. This includes the standard property tax in Spain is 10%, and legal fees can go up to 5%.

Example:

Property cost ( €150,000) + property tax (€15,000) + legal fees (€7,500) = Total costs (€172,500)

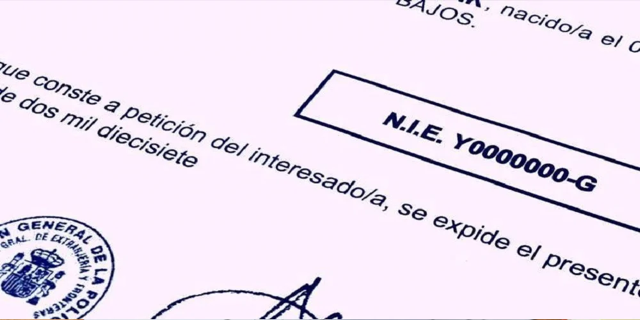

What is an NIE number?

Before buying a property in Spain you will first have to apply for a Spanish Tax Identification number (NIE number) which is assigned by the general commissariat for immigration and borders.

It is an identification number for foreigners in Spain as well as a tax reference number but does not entitle you to residency rights. It often takes up to 2 weeks to obtain an NIE however time frame may deferrer due to administrative factors.

How to apply for an NIE number?

You may request an NIE number directly in Spain or at the Consular Office in your resident country. You will need a passport and fill in the application form in which you must state the reason to justify the application such as to buy a property or accept employment.

Contact us to guide you in investing in Spanish property.

To become a Spanish resident, you may need to register for a Visa and EU national will have to register at the central registry for foreign nationals once established in Spain. It is important to check your own Visa requirements depending on your nationality.

Spanish Golden VISA

This initiative is available to non-EU citizens who invest in Spanish real estate above the value of €500,000 without a mortgage, permitting you to a resident’s visa. This was launched in Spain in 2013 to entice foreign investors granting benefits from facilitated access to a Spanish residence permit. This permit is granted for up to 3 years which also allows for the free movement through the rest of the 26 countries of the Schengen area.

Spanish Property Market Research

It is also vital do your own market research when buying a property in Spain, in particular into each of its individual regions which not only offer different scenery and lifestyle, but also different areas offer different tax rates. This is due to Spain being ran in a similar way to a federal state where ‘autonomous communities’ have a lot of power leading to a variety in how each area is governed. This means different areas have slightly different property markets so feel free to explore which area will be best suited to your needs. Choosing a location that aligns with your personal goals is essential for a successful and satisfactory property investment in Span. Explore our various articles to gain a greater understanding of the Spanish Property Market, with articles about the Spanish Economy as well as potentially monetary returns of the property market in Spain.